Silver Storm Invites PDAC 2026 Attendees to Visit the Company at Booth #2540 on March 1-4

Toronto, Ontario, February 27, 2026: Silver Storm Mining Ltd. (“Silver Storm” or the "Company") (TSX.V: SVRS | OTCQX: SVRSF | FSE: SVR) is pleased to invite attendees of the 2026 Prospectors & Developers Association of Canada (“PDAC”) Convention to visit the Company at Booth #2540 from Sunday, March 1, to Wednesday, March 4, 2026. Visitors will have an opportunity to engage directly with the Company and learn more about the ongoing rehabilitation work ahead of the potential restart of operations at the La Parrilla Silver Mine Complex in the second quarter of 2026.

The PDAC Convention will be held on March 1-4, 2026, at the Metro Toronto Convention Centre.

Greg McKenzie, President & CEO, will also be presenting live at the 2026 PDAC Convention:

DATE: Tuesday, March 3, 2026

TIME: 10:47 am EST

LOCATION: Room 801A

SESSION NAME: Silver and Royalty

Silver Storm Reports 50% Completion of Processing Plant Rehabilitation Activities at La Parrilla

Toronto, Ontario, February 26, 2026: Silver Storm Mining Ltd. (“Silver Storm” or the "Company") (TSX.V: SVRS | OTCQX: SVRSF | FSE: SVR) is pleased to provide an update on the progress of the processing plant rehabilitation activities at the Company’s 100%-owned past-producing La Parrilla Silver Mine Complex (“La Parrilla”) located in Durango State, Mexico.

Greg McKenzie, President and CEO, stated, “We are pleased to report that overall rehabilitation of the La Parrilla processing plant has reached 50% completion. This progress represents an important project milestone on the path to potentially restarting the operations at La Parrilla in the second quarter of 2026.”

The rehabilitation work at the La Parrilla processing plant includes significant advancements in several areas as outlined below:

Primary raw material feed and crushing circuit: Rehabilitation of the primary raw material feed and crushing circuit is nearing completion. Remaining work includes: a) refurbishment and strengthening of the primary run-of-mine material bins; and b) installation of the new vibrating grizzly screen and primary jaw crusher, with both of these long-lead items already on site. This work is scheduled to be completed in the next few weeks.

Flotation circuit: The eight new 1,000 ft3 sulphide flotation cells (see the news release titled “Silver Storm Commences the Expansion of the La Parrilla Sulphide Flotation Circuit to 1,250 tpd” released on February 3, 2026) have been set into their respective operating locations. Next steps will include installation of agitators, piping, and electrification. Silver Storm expects that installation of the new flotation cells will be fully completed by the end of the first quarter of 2026, which would allow the nominal processing capacity of the sulphide flotation circuit to be expanded from 1,000 tpd to 1,250 tpd. The existing eight cleaner cells are currently being refurbished and will be installed sequentially over the next 8-10 weeks.

Oxide circuit: The Company is in the process of rehabilitating six leach tanks, with ~40% of the work completed to date. Seven holding and conditioning tanks also require rehabilitation, and one conditioning tank will be replaced. The oxide circuit rehabilitation work is expected to be completed early in the second quarter of 2026.

Milling area: Rehabilitation of three ball mills and supporting infrastructure is underway. Milling area rehabilitation work includes relining of the ball mills, revamping of the cooling system, and installation of new cyclones and pumps, as required.

Silver Storm Sells Non-Core Capped Royalty in Nevada, USA

Toronto, Ontario, February 18, 2026: Silver Storm Mining Ltd. (“Silver Storm” or the "Company") (TSX.V: SVRS | OTCQX: SVRSF | FSE: SVR) is pleased to announce the sale of the non-core capped production gross royalty on the Springer Mine & Mill property (the “Springer Royalty”) in the state of Nevada, USA for gross proceeds of C$2,183,000 in cash.

The Company acquired the Springer Royalty as part of the acquisition of 100% of the issued and outstanding common shares of Till Capital Corp. (“Till”) in 2025 (see the news release titled “Silver Storm Mining and Till Capital Corporation Announce Completion of Plan of Arrangement” and published on July 18, 2025). Till’s royalty portfolio consisted of four mining royalties, including the Springer Royalty which is capped at US$2,500,000.

Greg McKenzie, President and CEO, commented, “Silver Storm acquired Till at a transaction value of C$7,200,000, which incorporated ~C$6,200,000 in cash held by Till prior to the closing of the transaction, implying a valuation of ~C$1,000,000 for Till’s portfolio of mineral investments and royalties. The Springer Royalty sale represented an opportunity to monetize one of our non-core royalty assets while adding financial flexibility and additional liquidity ahead of the potential restart of operations at the La Parrilla Silver Mine Complex in the second quarter of 2026.”

Silver Storm Commences the Expansion of the La Parrilla Sulphide Flotation Circuit to 1,250 tpd

Toronto, Ontario, February 03, 2026: Silver Storm Mining Ltd. (“Silver Storm” or the "Company") (TSX.V: SVRS | OTCQX: SVRSF | FSE: SVR), is pleased to report that all eight new flotation cells have been fabricated and delivered to site at the Company’s 100% owned La Parrilla Silver Mine Complex (the “La Parrilla Complex”) in Durango, Mexico.

The installation of the new 1,000 ft3 flotation cells, when combined with the existing processing equipment, will allow the processing capacity of the sulphide flotation circuit at the La Parrilla Complex to be expanded from 1,000 tpd to 1,250 tpd. Two of the new cells have already been installed, with the remaining six cells slated for installation during the first quarter of 2026.

Greg McKenzie, President and CEO, commented, “The installation of the new flotation cells and the subsequent expansion of the sulphide flotation circuit at La Parrilla represent an important step toward the potential restart of operations in the second quarter of 2026. The expansion of the sulphide circuit aligns with the sulphide-dominant nature of the La Parrilla mineral resource.”

Silver Storm to Present at the 2026 Vancouver Resource Investor Conference

Toronto, Ontario, January 21, 2026: Silver Storm Mining Ltd. (“Silver Storm” or the "Company") (TSX.V: SVRS | OTCQX: SVRSF | FSE: SVR) is pleased to announce that Greg McKenzie, President & CEO, will present live at the 2026 Vancouver Resource Investor Conference (the “VRIC”), being held at the Vancouver Convention Centre West Building on January 25-26, 2026.

DATE: January 25, 2026

TIME: 2:00 pm PST

LOCATION: Workshop 1, Vancouver Convention Centre West Building

Silver Storm also invites attendees to visit it at Booth #313. Visitors will have an opportunity to engage directly with the Company and learn more about the ongoing rehabilitation work and drilling program ahead of the potential restart of operations at the La Parrilla Silver Mine Complex in the second quarter of 2026.

Investors interested in attending the VRIC can register here: https://cambridgehouse.com/vancouver-resource-investment-conference

Silver Storm Upgraded to Trade on the OTCQX Best Market

Toronto, Ontario, January 15, 2026: Silver Storm Mining Ltd. (“Silver Storm” or the "Company") (TSX.V: SVRS | OTCQX: SVRSF | FSE: SVR) is pleased to announce that it has qualified to trade on the OTCQX® Best Market (the “OTCQX Market”), upgrading from the OTCQB® Venture Market (“OTCQB Market”). Effective today, the common shares of the Company (“Shares”) will commence trading on the OTCQX Market under the symbol “SVRSF”. The Company’s Shares will continue to be listed and trade on the TSX Venture Exchange (“TSXV”) under the symbol “SVRS” and on the Frankfurt Stock Exchange under the symbol “SVR”.

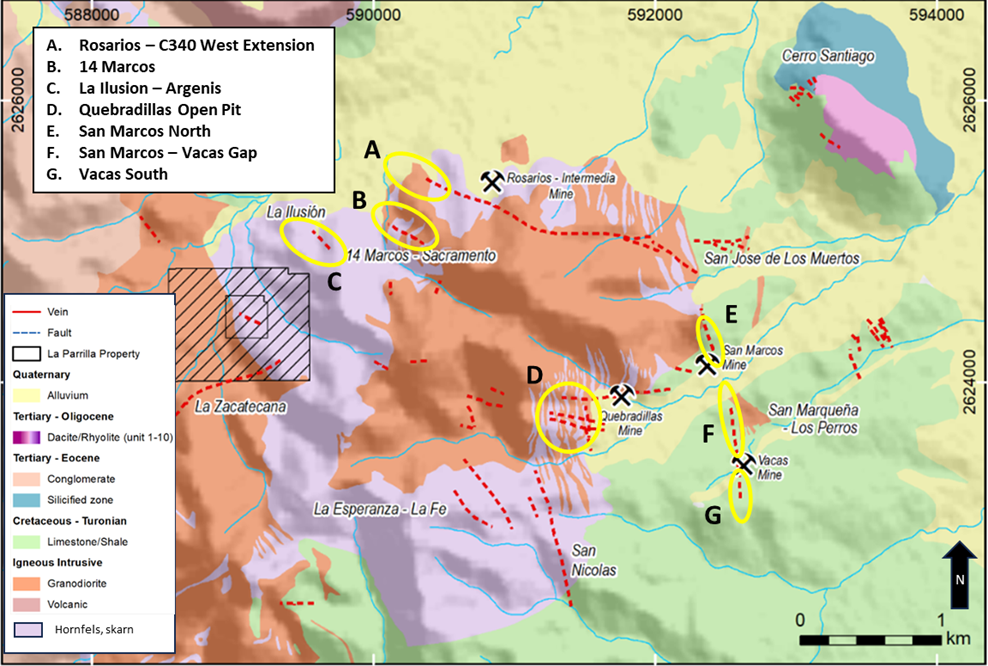

SILVER STORM COMMENCES 6,000 METRE DRILLING CAMPAIGN AT LA PARRILLA SILVER MINE COMPLEX

Toronto, Ontario, January 14, 2026: Silver Storm Mining Ltd. (“Silver Storm” or the "Company") (TSX.V: SVRS | OTC: SVRSF | FSE: SVR), is pleased to announce the commencement of underground drilling at its 100% owned La Parrilla Silver Mine Complex (the “La Parrilla Complex”), located 76 kilometres southeast of Durango, Mexico.